Losing a parent is emotionally overwhelming and legally complex. This checklist-style guide walks U.S.-based family caregivers through the immediate legal and practical tasks after a parent dies, explaining what documents matter, who to notify, and the legal steps that follow so you can act efficiently and protect the estate, benefits, and family interests.

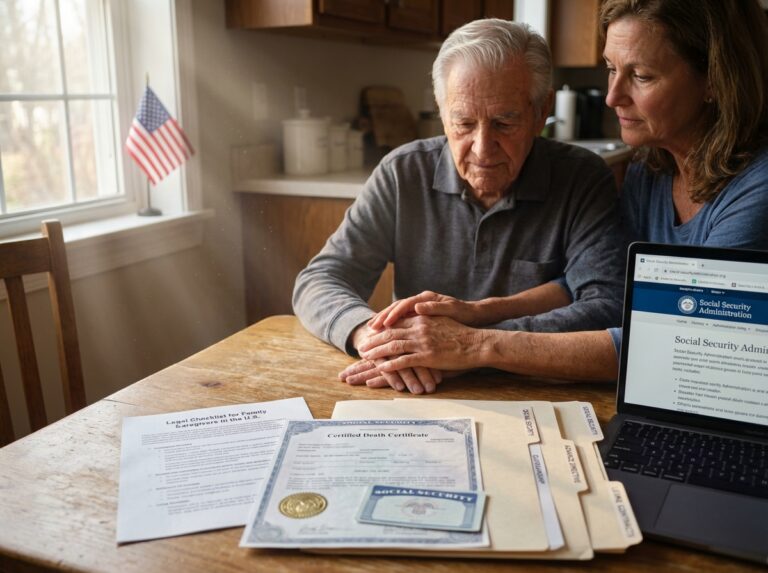

First Immediate Steps at the Time of Death

The first few hours after a parent passes away are often a blur of emotion and urgent requirements. You are forced to shift from a role of support to one of legal administration almost instantly. The immediate priority is the formal pronouncement of death. If your parent was in a hospital or a nursing facility, the staff handles this by calling a physician or a nurse practitioner. If they were at home under hospice care, you must call the hospice nurse instead of emergency services. The nurse will come to the home to certify the time of death. In cases where a death is sudden or occurs at home without hospice involvement, you must call 911. You should inform the dispatcher that the death was expected if that is the case. This helps avoid unnecessary sirens or aggressive resuscitation efforts.

Coroner Involvement and Autopsies

A coroner or medical examiner usually becomes involved if the death was unexpected, suspicious, or occurred without a physician present. They have the authority to take the body for an investigation. This process can take up to 72 hours. You should not move anything in the room if the death appears unusual. Preserving the scene is vital for any potential investigation. If the death was expected and a physician is willing to sign the certificate, the body can usually be released directly to a funeral home.

Organ Donation Protocols

Timing is everything for organ and tissue donation. If your parent was a registered donor, you need to notify the medical staff or the funeral home immediately. Most successful donations happen within the first few hours. Check their driver’s license or advance directive for a donor sticker or statement. Even if they were not registered, the next of kin can often authorize donation. This is a time-sensitive decision that requires quick coordination with a procurement organization.

Authorizing Disposition

State laws dictate who has the legal right to decide on burial or cremation. This is usually the surviving spouse, followed by adult children. If there are multiple children, most states require a majority or even a unanimous agreement before a funeral home proceeds. If your parent named a specific person in a formal Appointment of Agent for Disposition of Remains, that document takes precedence over family hierarchy. You will need to provide this document to the funeral home to prove you have the authority to sign for the cremation or burial.

Contacting the Funeral Home

You should choose and contact a funeral home within the first 24 hours. They act as your primary liaison for the legal paperwork. They will transport the body and begin the process of filing the death certificate with the state vital records office. Provide them with your parent’s Social Security number, birth date, and parents’ names. This information is required for the official record. The funeral director will also ask how many certified copies of the death certificate you need.

Ordering Death Certificates

You will need more copies than you think. Most experts recommend ordering 10 to 12 certified copies. You can find more details on how to get a certified copy of a death certificate | USAGov. Each financial institution, insurance company, and government agency will likely require an original certified copy rather than a photocopy. For example, the Social Security Administration needs one to stop benefits and process survivor claims. Life insurance companies require them to pay out policies. In Pennsylvania, these certificates cost about 20 dollars each. In Washington D.C., the requirements for applicants are strict. If you are an adult child, you might need to show a photo ID and a pay stub from the last 60 days. If a kiosk fails to verify your identity, you may need to provide three different forms of identification. You can learn more about the process through this step-by-step guide | FreeWill.

Gathering Critical Papers

While waiting for the body to be moved, start a basic search for essential documents. Look for the original will, life insurance policies, and any advance directives. Do not worry about organizing them yet. Just get them in one place. If you find scattered papers or sticky notes with passwords, take clear photos of them with your phone. These photos serve as a digital backup and a timestamp of where things were found. Locate the health insurance cards and any military discharge papers like a DD214. These are necessary for claiming VA burial benefits.

Immediate Emotional Support

Do not try to handle these 72 hours alone. Call a trusted friend or a family member to sit with you. Their job is not to handle the legalities but to handle the phone calls to other relatives or to bring you food. Having someone else present helps you stay focused when the funeral director or the coroner asks for specific details. This is the time to lean on your community so you can manage the heavy administrative lifting that starts the moment the pronouncement is made. Remember that any power of attorney your parent signed is now void. The authority to act now shifts to the executor named in the will or the next of kin.

Locate and Preserve Important Documents and Records

Finding the right paperwork is the next big task after the initial shock of loss begins to settle. You need to gather everything before you start calling banks or government offices. Start with the original will. If there are codicils or amendments, keep them together. The probate court usually requires the physical original document. Photocopies often cause delays or legal hurdles in the court system. If your parent had a trust, find the trust agreement. You will need the contact information for the successor trustee to begin the administration process.

The Status of Legal Authority

It is important to understand that the durable power of attorney is no longer valid. These documents terminate the moment someone passes away. You cannot use a power of attorney to sign checks or sell property now. The executor or the trustee takes over those responsibilities. You should still keep the power of attorney document for your records. It shows you had authority while they were alive. Look for the advance healthcare directive and the Physician Orders for Life-Sustaining Treatment. These might contain instructions about organ donation or final wishes that were not in the will. Even if the medical decisions are over, these papers are part of the legal history of the estate.

Financial and Property Records

Beneficiary designations are critical. These apply to life insurance policies, retirement accounts, and payable on death bank assets. These assets usually bypass probate. They go directly to the person named on the form. You need to find the most recent versions of these designations to ensure the funds reach the right people. Gather all property deeds and vehicle titles. Look for mortgage statements and loan documents. You need to know if there are liens or outstanding balances. Bank and brokerage account statements from the last few months are necessary. They help you identify where the money is and what bills are being paid automatically. Tax returns from the last three to seven years are helpful. They show income sources and assets you might not know about. Find the Social Security card and the number. You will need this for almost every form you fill out. If your parent served in the military, find the DD214 or other discharge papers. These are required to claim VA burial benefits or survivor pensions. Some states like Pennsylvania even offer fee waivers for death certificates for veterans.

Care and Medical Documentation

Long term care contracts and nursing home admission agreements are important. They outline refund policies for deposits or prepaid care. If there was a caregiver agreement or records of payments to home health aides, keep those. They are evidence if Medicaid questions asset transfers later. Medicaid has a five year lookback period. This means they check for any gifts or transfers made in the sixty months before the application. Having clear pay records for caregivers proves that money was paid for services rather than given away. Medicaid and Medicare paperwork should be kept in a separate folder for easy access. You may need these to settle final medical bills or to deal with estate recovery programs.

| Document Category | Specific Items to Locate | Why It Is Essential |

|---|---|---|

| Estate Planning | Original Will, Codicils, Trust Agreements | Determines who manages the estate and who inherits. |

| Financial Assets | Bank Statements, Brokerage Records, Life Insurance | Identifies the total value of the estate and beneficiaries. |

| Property Ownership | Deeds, Titles, Mortgage Documents | Confirms ownership and any outstanding debts or liens. |

| Government Records | Social Security Card, Military Discharge (DD214) | Required for survivor benefits and death certificate requests. |

| Medical and Care | LTC Contracts, Medicaid Papers, Caregiver Logs | Protects against Medicaid recovery and clarifies refund rights. |

Digital Assets and Passwords

Digital accounts are the new frontier of estate management. Try to find a list of passwords or a digital vault. This includes email, social media, and utility portals. Do not delete anything yet. Accessing these accounts can help you find electronic statements that were never mailed. If your parent used a legacy contact feature on their phone or computer, that person should begin the access process now.

Preservation Best Practices

Preserving these originals is your main job right now. Put the original will and deeds in a fireproof safe or a locked drawer. Scan every page of every document. Save these digital copies in a secure cloud folder. Create an inventory list. Take a photo of each document where you found it. Note the date you found it. This creates a clear record for the court. You will need these records when you apply for certified copies of a death certificate because you must prove your legal standing. Never destroy any papers. Even if a document looks old or irrelevant, keep it. Shredding papers can look suspicious if a family member contests the estate. You must maintain a clear chain of custody for all evidence. If you move a document from a desk to a safe, record that move. This protects you from claims of mishandling the estate assets.

Notify Agencies Banks and Benefit Providers

Once you have secured the initial documents and ordered your certified death certificates (as detailed in the first section), you must begin the notification process. While a simple photocopy might work for a gym membership, it will not work for a bank or a life insurance claim. Expect a wait of two to four weeks for these documents to arrive from the state vital records office.

The funeral home usually reports the death to the Social Security Administration. You should still call the agency yourself to confirm. This is vital because any payment sent in the month of death must be returned. If the payment was already deposited, the bank will often pull it back automatically. You should also ask about survivor benefits or the one-time death payment of 255 dollars. If your parent was on Medicare, that coverage needs to be canceled immediately. This prevents identity thieves from using the number for fraudulent medical claims.

If your parent was a veteran, contact the Department of Veterans Affairs. They offer burial benefits and sometimes survivor pensions. You will need the DD214 discharge papers to start this process. For life insurance, the company will require a certified death certificate that includes the cause of death. Some states like Pennsylvania issue two versions of the certificate. You must ensure you get the one with medical information for insurance purposes. The insurer will provide a claim form for the beneficiaries to sign. Most claims are processed within 30 days once the paperwork is submitted.

Notify the human resources department or the pension administrator if your parent was still working or receiving retirement checks. They will explain the options for 401k accounts or pension survivor benefits. These often have a 90 day window for making elections. You should also contact the banks to freeze accounts. This stops unauthorized access. It also stops automatic bill payments. You must review bank statements to see which bills were on autopay. If you do not move those bills to a different payment method, the power or water at the house could be shut off.

Call the credit bureaus like Equifax, Experian, and TransUnion. Ask them to place a deceased alert on your parent’s credit report. This is a powerful tool against fraud. It prevents anyone from opening new credit cards or loans in your parent’s name. You should also notify credit card companies directly. They will close the accounts and stop interest from accruing. If there is a mortgage, call the servicer. Do not stop making payments if you intend to keep the property. They have specific departments to help heirs take over the account.

Digital accounts and subscriptions are often overlooked. You can use a death certificate to close email accounts or social media profiles. Some platforms allow you to turn a profile into a memorial page. For smaller services like streaming or magazines, a photocopy of the death certificate is usually enough. You should also check for any automatic renewals on cloud storage or software.

| Agency or Institution | Typical Documents Needed | Recommended Timing |

|---|---|---|

| Social Security Administration | Social Security Number, Death Certificate | Within 24 to 72 hours |

| Life Insurance Companies | Certified Death Certificate (with cause), Claim Form | Within 1 to 2 weeks |

| Banks and Credit Unions | Certified Death Certificate, Letters Testamentary | Immediately after receiving certificates |

| Credit Bureaus | Death Certificate, Proof of Executor Status | Within the first month |

| Department of Veterans Affairs | DD214, Death Certificate | Within 2 weeks |

When you contact these agencies, be prepared for specific eligibility rules regarding who can request information. Keep a log of every person you speak with at these agencies. Note the date, the time, and any claim numbers they provide. This will save you hours of frustration if a file gets lost or a benefit is delayed. The process of notification is long. It requires patience and a lot of stamps. But doing this correctly in the first few weeks protects the estate from fraud. It also ensures that beneficiaries receive the money they are entitled to without unnecessary legal hurdles.

Estate Administration Probate Trusts and Taxes

Administering an estate starts with identifying what actually needs to go through court. Not everything a parent owned is part of the probate process. Nonprobate assets include things like life insurance policies with a named beneficiary. Bank accounts set up as payable on death or transfer on death also bypass the court. These assets transfer directly to the person named without a judge getting involved. Jointly owned property with rights of survivorship works the same way. Probate assets are usually items owned solely by the parent with no designated beneficiary. This often includes real estate held only in their name. It also includes personal belongings like cars, furniture, or jewelry.

The Role of the Executor and Opening the Case

The person in charge of this process is the executor if there is a valid will. If there is no will, the court appoints a personal representative or administrator. This role carries significant legal responsibility. You have to manage the assets. You must pay debts before anyone gets an inheritance. To start, you must file a petition with the local probate court in the county where your parent lived. You will need the original will. You also need several certified copies of the death certificate. The court then issues Letters Testamentary or Letters of Administration. These documents give you the legal power to talk to banks. They allow you to sign papers for the estate. You can order these certificates through services like VitalChek if you need more copies quickly.

Probate Alternatives and Trusts

Many families can avoid a full, lengthy probate process. If the estate value is below a certain limit, you might use a small estate affidavit. These limits vary by state. In New York, the limit is $50,000. In California, it is $184,500. These procedures are faster. They are also much cheaper than traditional probate. Revocable living trusts are another way to skip court. If your parent moved their assets into a trust while they were alive, the successor trustee can manage everything privately. This avoids the public record of a probate court. It also speeds up the distribution of assets to heirs.

Immediate Financial Steps for the Estate

Securing the Property

You must secure the house immediately. Change the locks if you are worried about unauthorized access. Do not let relatives take items until the inventory is complete. You should take photos of every room to document the contents. This prevents disputes later about what was in the house.

Managing Liquidity

You need to open an estate bank account. This keeps estate funds separate from your own money. Never mix estate cash with your personal accounts. This is called commingling. It can lead to legal trouble or personal liability. You will use this account to pay urgent bills. This includes utility payments to keep the lights on or insurance premiums for the property.

Notifying Creditors

You must notify creditors by publishing a notice in a local newspaper. This starts a legal clock for them to file claims. In many states, this period lasts three to four months. Once this time passes, creditors usually cannot come back for more money. You should pay valid debts in the order required by state law.

Retirement Accounts and Tax Considerations

| Asset Type | Tax Treatment | Distribution Rule |

|---|---|---|

| Inherited IRA | Taxed as income | 10-year rule for most heirs |

| Life Insurance | Generally tax-free | Lump sum to beneficiary |

| Estate Assets | Step-up in basis | Value at date of death |

Handling retirement accounts like IRAs requires care. Beneficiaries must follow specific rules for required minimum distributions. If you inherit an IRA, you usually have to empty the account within ten years. This can create a large tax bill if not managed correctly. Life insurance is different. It is generally not taxable income. You just need to file a claim with the company using a death certificate. Taxes are a separate hurdle. You might need to file a final income tax return for your parent. If the estate is very large, a federal estate tax return might be due within nine months. For 2025, the federal exemption is $13.99 million. However, some states have much lower thresholds for state estate taxes. You should consult a tax professional to avoid penalties.

Common Pitfalls and When to Hire an Attorney

Probate is rarely fast. It often takes six to eighteen months. One common mistake is selling a parent’s house before the court gives you authority. Another pitfall is paying a sibling their share before all the bills are settled. If the estate is simple and small, you might handle it yourself. If there are disputes among family members, hiring a probate attorney is the safer choice. You should also seek legal help if there are complex business assets or if the will is being contested. An attorney ensures you follow the strict timelines of the court.

Healthcare Legal Instruments Powers of Attorney Advance Directives and Long Term Care Contracts

The Transition of Legal Authority

The moment a parent passes away, the legal tools you used to manage their life change instantly. Many people think a durable power of attorney stays active to help pay for the funeral or close accounts. That is not how it works. The authority of an agent under a power of attorney ends the moment the person dies. At that point, the executor named in the will or a court appointed administrator takes over. If you were the agent, you must stop signing documents in that capacity immediately. Using a power of attorney after a death can lead to personal liability. The bank will freeze accounts as soon as they are notified of the death, so the power of attorney becomes useless for financial transactions. You should focus on handing over records to the person who will manage the estate.

Medical Directives and Post Death Decisions

Advance directives are documents that guide medical care when a person cannot speak for themselves. These papers are vital during the final days, but they also contain instructions for what happens next. Many people include their wishes for organ donation in these documents. You must act quickly if donation is mentioned because medical teams have a very short window to proceed. These directives might also explain how the parent wanted their remains handled. Checking these papers is one of the first things you should do after the death occurs. Some directives also include a healthcare proxy who can make decisions about an autopsy or the release of the body to a funeral home. These instructions are the final act of the parent’s autonomy, and following them ensures their wishes are respected.

Court Ordered Roles and Their Limits

If a court appointed you as a guardian or a conservator, your legal power also ends at death. You will likely need to file a final report with the court to close the case. Even though your power ends, the decisions you made while they were alive still matter. Contracts you signed for their care or assets you moved can impact how the state looks at the estate later. The court will want to see a final accounting of all the money that passed through your hands. This process ensures that all creditors are identified and the remaining assets are ready for the probate process. It is a formal way to end your legal responsibility to the court and the deceased.

Navigating Long Term Care Contracts

Reviewing the contract with a nursing home or assisted living facility is a priority. These documents are often long and full of legal jargon. Look for arbitration clauses that might limit your right to sue for negligence. Check the rules about admission deposits. Some facilities try to keep these funds or apply them to final bills without a clear breakdown. You also need to know the bed hold policy. This tells you how long the facility will keep the room before they start charging for a new resident. Most places require a specific notice period even after a death occurs. This means the estate might be billed for several weeks of care while the room is being cleared out. You should also look for clauses regarding liability for personal property left in the room during the transition.

Medicaid Rules and Estate Recovery

Medicaid rules are complex and vary by state. The five year lookback is a major factor. This rule means the government looks at any assets given away or transferred for less than market value in the five years before applying for benefits. If your parent moved money to family members during this time, it could create a penalty period. For example, giving a house to a child or making large cash gifts can trigger these rules. State agencies also have the right to seek estate recovery. This means they can try to get paid back for the cost of long term care from the assets left behind. Irrevocable trusts are one way people try to protect assets, but these must be set up correctly years in advance. You should talk to an elder law attorney immediately if Medicaid was involved in your parent’s care. They can help you navigate the recovery process and protect what is legally yours.

Final Steps with the Facility

When you are ready to close the account at the facility, ask for an itemized statement. This should show every charge for the final month of care. Do not just pay a lump sum. You want to see the final accounting to ensure there are no errors or double billings. You will need a certified copy of a death certificate to finalize these matters. Once you have the statement, review it for any services that were not provided. Ask for a refund of any prepaid rent or unused personal funds. Getting a final accounting in writing protects the executor from future claims by creditors or heirs. It is the last step in managing the physical environment where your parent lived and ensures the estate is not overcharged for services.

Common Questions Families Ask About Legal Next Steps

Who can access medical records after death and how does HIPAA apply?

HIPAA protections do not vanish when someone dies. These rules stay in place for 50 years after the date of death. During this time, the deceased person’s personal representative has the legal right to access medical records. This is usually the executor named in the will or someone appointed by a probate court. If your parent had a healthcare power of attorney, that person might have had access while the parent was alive, but that authority ends at the moment of death. You will likely need to show the healthcare provider a certified death certificate and court documents proving you are the legal representative of the estate to get these files.

Does a power of attorney let someone close bank accounts after death?

No. A power of attorney is only valid while the person who signed it is alive. The moment a parent passes away, the power of attorney becomes void. You cannot use it to withdraw money, pay bills, or close accounts. If you try to use a power of attorney after death, you could face legal trouble. After death, the executor or administrator of the estate takes over.

What happens to a joint bank account at death?

Most joint bank accounts in the U.S. include a right of survivorship. This means the money in the account automatically belongs to the surviving account holder. It does not go through probate. The survivor can continue to use the account without interruption. However, if the account was set up as a convenience account without survivorship rights, the deceased person’s portion might become part of the estate. You should check the specific terms of the account with the bank. If there is a beneficiary named on the account, often called a Payable on Death or POD designation, that person can claim the funds by showing a death certificate and their own identification.

How many death certificates should be ordered?

Experts usually suggest ordering 10 to 12 certified copies. You will need them for many different tasks. Each life insurance company, bank, and investment firm will likely require an original certified copy. You also need them for the Social Security Administration, the Veterans Affairs office, and the probate court. Some agencies might return the certificate, but many will keep it. It is much easier to order enough copies at the start than to go back and request more later. Keep in mind that as of December 1, 2025, NYC has stopped accepting new requests for 1950 death certificates, so always check for the most recent local policy changes.

When is probate required and how long does it take?

Probate is the court process of settling an estate. It is required if the deceased person owned assets in their name alone that do not have a designated beneficiary. Each state has a small estate threshold. For example, in New York, if the assets are under $50,000, you might use a simpler process. If the estate is larger, full probate is necessary. On average, probate takes between 6 and 18 months. It involves identifying assets, paying debts, and distributing what remains to the heirs. If there is a conflict among family members or a complex business involved, it can take much longer.

How to find additional beneficiaries named outside the will?

Many assets pass directly to people without being mentioned in a will. These are called non-probate assets. You should look for life insurance policies, retirement accounts like 401ks or IRAs, and transfer on death deeds for real estate. Check the parent’s mail for statements from insurance companies or investment firms. You can also use the USA.gov resources to find contact information for federal agencies. If you suspect there is a policy but cannot find the paperwork, some states have search tools for unclaimed life insurance benefits.

What are the deadlines for filing claims and tax returns?

Creditors usually have a limited window to file claims against an estate. This period is often between 3 and 6 months after the probate case is opened and a public notice is published. For taxes, the federal estate tax return, IRS Form 706, is due 9 months after the date of death. Most estates do not owe federal estate tax because the exemption is very high, but you might still need to file a final income tax return for the parent. State inheritance or estate tax deadlines vary, so checking with a local tax professional is a smart move.

Can the long-term care facility charge after death?

A nursing home or assisted living facility can often charge for a notice period or until the room is fully cleared of belongings. You must review the contract signed at admission. Some contracts have a 14-day or 30-day notice requirement. If the parent was on Medicaid, the state might attempt estate recovery to get back the money spent on their care. This is a complex area of law. You should ask the facility for an itemized final statement and a full accounting of any deposits held. Do not pay these bills with your own money. They are the responsibility of the estate.

When to consult an attorney and where to find one?

You should talk to a lawyer if the estate is large, if there are debts that exceed the assets, or if family members are arguing. An elder law or probate attorney can help navigate Medicaid recovery and court filings. You can find qualified lawyers through the National Academy of Elder Law Attorneys or your local bar association. For federal matters, you should contact the Social Security Administration to report the death and the Department of Veterans Affairs if the parent was a veteran. The IRS also provides a guide for executors on their website. Always confirm specific rules with local counsel since state laws change frequently.

Final Summary and Practical Next Steps

The first few days after losing a parent are often a blur of emotion and urgent tasks. You might feel pressured to make big decisions quickly. It is better to focus on the immediate legal requirements first. This summary helps you organize the tasks into manageable steps for the coming months. You can use this structure to protect the estate and ensure you follow the law.

The First Week

Your priority is the physical care of your parent and the security of their home. If they died at home under hospice care, you should call the hospice nurse. They will handle the pronouncement of death. If the death was unexpected, you must call the authorities. Contact a funeral home to arrange for transportation. They usually notify the Social Security Administration for you. You should confirm this within a few days.

Locate the original will and any trust documents. These papers dictate who has the legal authority to act. If there is a trust, the successor trustee takes over immediately. If there is only a will, the executor must wait for court approval. Secure the residence by locking all doors and windows. You should not let relatives take items from the house yet. This prevents disputes and ensures an accurate inventory for the court. Check for any immediate bills that need payment like electricity or water. Do not use your own money for these if possible. Keep a detailed log of every expense you pay out of pocket.

The First Month

This is when the heavy paperwork begins. You need to get a certified copy of a death certificate to start most legal processes. Most experts suggest ordering 10 to 12 certified copies. You will need them for banks, insurance companies, and the probate court. You can Order Death Certificates Online if you cannot go to the vital records office in person.

Once you have the certificates, notify the life insurance companies. Contact the bank to see if accounts have a named beneficiary. If the accounts were joint, the survivor usually gets access right away. If the accounts were only in the parent’s name, you likely need to open probate. File the will with the local probate court. This starts the legal process of transferring assets. You should also notify the Veterans Affairs office if your parent served in the military. They might provide burial benefits or survivor support.

The First Six Months

The middle phase of settling an estate involves managing debts and taxes. Most states have a specific window for creditors to file claims against the estate. This period often lasts three to six months after you open probate. You should wait until this window closes before you distribute significant money to heirs. If you pay beneficiaries too early, you might be held personally responsible for unpaid estate debts.

Work with a tax professional to file the final income tax return for your parent. You may also need to file an estate tax return if the assets exceed certain limits. Inventory all property including real estate, vehicles, and personal belongings. If the house needs to be sold, you will need the court’s permission or authority granted in the will. Keep a single shared digital document inventory. This helps all family members stay informed and reduces suspicion. Avoid signing any long term care contracts or facility settlements without legal review. Some facilities might try to hold you personally liable for remaining balances.

Red Flags and Legal Advice

Some situations require immediate help from a probate or elder law attorney. If you cannot find a will, the state laws of intestacy will decide who gets the assets. This often leads to family conflict. If the property deed is not updated or the property is unregistered, you will face hurdles in selling the home.

Family disputes over small items can escalate into expensive lawsuits. It is better to involve a mediator or lawyer early if tensions rise. Another major red flag is Medicaid estate recovery. If your parent received state help for nursing home care, the state might place a lien on the house. An attorney can help you understand if there are any exemptions for surviving family members.

Using this checklist helps you stay organized during a difficult time. It protects the legacy your parent left behind. You can honor their wishes by handling the details with care and transparency. Taking these steps one at a time makes the process feel less overwhelming.

References

- Death Certificates | doh – DC Health — You must be named as a spouse on the death certificate. Domestic partner. You must be named as a domestic partner on the death certificate. Parent You must be …

- How Long Does It Take to Get a Death Certificate in 2025? — Full name and date of death; Your relationship to the deceased; Government-issued ID; Proof of legal standing to request the document. Who Can …

- How to get a certified copy of a death certificate | USAGov — Some states release death certificates 25 or more years after death. Check with your state's vital records office to find out when death …

- Death Certificates | Department of Health — You must complete an Application for Death Certificate. You must show valid identification. You must sign your application. You must be an eligible applicant.

- How to get a death certificate: A step-by-step guide | FreeWill — You need a death certificate to: Bury or cremate the person's body. Proof of death is required before burying or cremating someone's body.

- How to Get a Death Certificate After a Loved One Dies — You'll also need a form of identification to prove that you are a close family member, unless enough time has passed to make the death certificate part of the …

- Agencies to notify when someone dies | USAGov — You'll need the person's Social Security number and certified copies of their death certificate for most agencies and programs. … Death of a …

- Death | Travel.State.gov — U.S. entry requirements … The local death certificate and the consular mortuary certificate for the remains usually meet U.S. quarantine needs.

- Death Certificates – NYC Health — Effective December 1, 2025, we will no longer accept new requests for certified copies of 1950 death certificates. We appreciate your cooperation during this …

- Order Death Certificates Online | VitalChek — Full name, date of death and place of death. Identification: Not all orders require this, but you may need a valid government-issued ID (e.g., driver's license, …

EMPTY