When a loved one dies, family caregivers must act swiftly to claim Social Security survivor benefits while managing legal tasks like powers of attorney, guardianship, advance directives, and long-term care contracts. This article explains eligibility, required documents, step-by-step filing tips, common legal pitfalls, and a practical checklist to help U.S. caregivers move confidently through the process.

Overview of Social Security Survivor Benefits

Understanding the financial landscape after the loss of a loved one is a heavy task for any caregiver. Social Security survivor benefits serve as a critical safety net for families in the United States. These benefits are not a form of public assistance; they are earned through years of labor and payroll taxes. When a worker pays into the system, they are essentially buying insurance for their family. If that worker passes away, certain family members become eligible for monthly payments to help replace lost income. As we move through 2025, it is more important than ever to recognize that these funds belong to the survivors by law. They provide a sense of stability during a period of profound transition.

The Foundation of Work Credits

Eligibility for these benefits depends on the work history of the deceased person. Social Security uses a credit system to track how much someone has contributed to the program. Most workers need to earn 40 credits to be fully insured, which usually equates to about 10 years of work. However, the system is designed to be flexible for younger workers who might not have had a full decade in the workforce. Family members can sometimes qualify for benefits even if the deceased had as few as one and a half years of work in the three years right before their death. This special rule ensures that young families are not left entirely without resources if a parent or spouse dies unexpectedly. You can find more details on these specific requirements in the official Survivors Benefits documentation provided by the government.

Spousal Eligibility and Age Requirements

The most common recipients of survivor benefits are widows and widowers. Generally, a surviving spouse can begin receiving benefits at age 60. If the surviving spouse has a disability, they can apply as early as age 50. The amount of the payment changes based on when you choose to start. If you wait until your full retirement age—which is currently between 66 and 67 for most people—you can receive 100 percent of the deceased worker’s benefit amount. Claiming earlier results in a reduced monthly payment. It is a personal decision that depends on your current financial needs and other sources of income. You can review the percentage breakdowns at What you could get from Survivor benefits | SSA – Social Security to see how timing affects the final check.

Caring for Children and Special Circumstances

Age requirements for a spouse are waived in specific caregiving scenarios. If a surviving spouse is caring for the deceased worker’s child and that child is under age 16, the spouse can receive benefits regardless of their own age. This also applies if the spouse is caring for a child of the deceased who became disabled before age 22. In these cases, the benefit is typically 75 percent of the worker’s basic amount. This is a vital provision for stay-at-home caregivers who may have been out of the workforce for years. It recognizes the economic value of caregiving and provides the necessary funds to maintain the household while raising children.

Rights of Divorced Spouses

A common misconception is that a divorce ends all claims to a former partner’s Social Security record. This is not true. A surviving divorced spouse can often receive the same benefits as a widow or widower. To qualify, the marriage must have lasted at least 10 years. The divorced spouse must also be at least 60 years old, or 50 if disabled. If the divorced spouse is caring for a child of the deceased who is under 16 or disabled, the 10-year marriage rule does not apply. Importantly, benefits paid to a surviving divorced spouse do not reduce the amount paid to a current spouse or other family members; the system treats these as separate entitlements.

Benefits for Children and Dependent Parents

Children are often the most vulnerable after a parent dies. Unmarried children under age 18 can receive monthly payments. This eligibility extends to age 19 if the child is still a full-time student in a secondary school. If a child has a disability that began before they turned 22, they can receive survivor benefits for as long as the disability continues. In some rare cases, even dependent parents can qualify. If a worker was providing at least half of the financial support for their parents and those parents are age 62 or older, they may be eligible for benefits. This highlights the broad reach of the program in supporting the entire family unit. More information on these categories is available at Who can get Survivor benefits | SSA – Social Security.

Types of Payments, Retroactive Limits, and the Lump Sum

There are two distinct types of payments available through this program. The first is the monthly survivor benefit which provides ongoing income. It is critical to understand that there is no strict expiration date for filing, but practical limits exist regarding retroactive payments. Most survivor benefits are only retroactive for up to 12 months. If you wait two years to file, you might lose an entire year of payments permanently. The second type is the lump sum death payment. This is a one-time payment of $255. While the amount is small, it is intended to help with immediate funeral or legal costs. This payment is only available to a surviving spouse who was living with the worker or a child who is eligible for benefits on the worker’s record. You must apply for this specific payment within two years of the date of death or you will lose the right to claim it.

The Role of the Representative Payee

When the person entitled to benefits is a minor or an adult who cannot manage their own finances, the Social Security Administration appoints a representative payee. This is often a family caregiver or a legal guardian. The payee is responsible for using the funds for the beneficiary’s current needs, such as food, clothing, and housing. Any money left over must be saved in an interest-bearing account for the beneficiary’s future use. Being a representative payee is a serious legal responsibility that requires careful record-keeping and annual reporting to the government.

Debunking Common Misconceptions

Many people believe that benefits start automatically once a death certificate is issued. This is false. While funeral directors often report deaths to the Social Security Administration, this does not count as an application for benefits. You must contact the agency directly to start the process. Another myth involves remarriage. If you are a surviving spouse and you remarry after age 60 (or age 50 if disabled), your eligibility for survivor benefits on your prior spouse’s record is usually unaffected. However, if you remarry before those ages, you generally cannot receive survivor benefits on your former spouse’s record unless the subsequent marriage ends. Some people find that the benefit from their new spouse’s record is higher than the survivor benefit from their previous spouse; you can choose the higher amount, but you cannot receive both full benefits simultaneously.

Legal Documents and Essential Checklist for Caregivers

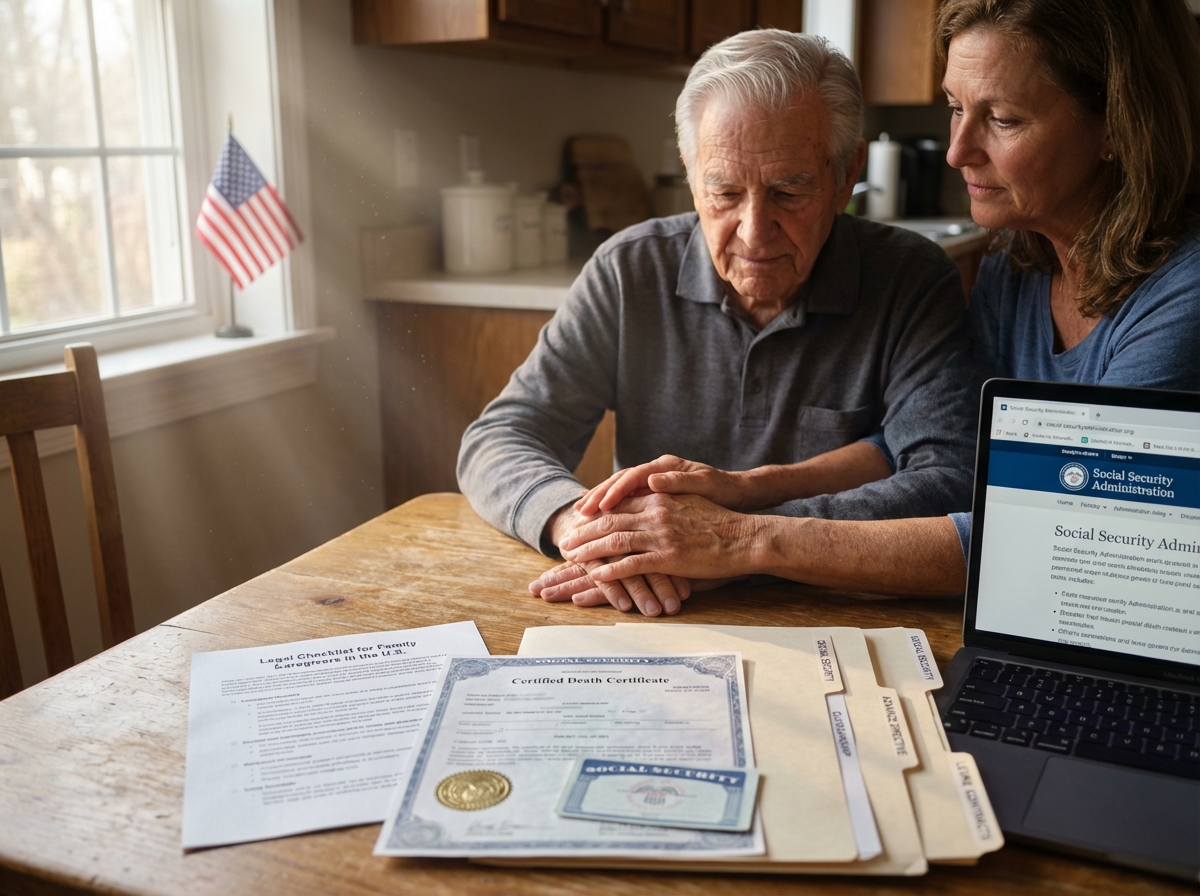

Gathering the right paperwork is the most taxing part of being a caregiver after a loss. You are likely exhausted. Having a clear list helps you move through the administrative fog without missing critical details. The Social Security Administration requires specific evidence to process survivor claims. They prefer original documents or copies certified by the issuing agency. Photocopies you make at home are usually not accepted.

The Essential Document Checklist

Identity and Relationship Records

You must prove who you are and how you were related to the deceased worker. This starts with Social Security numbers for both yourself and the person who passed away. You need original birth certificates for yourself and any children applying for benefits. If you are a surviving spouse, the original marriage certificate is required. For those who were divorced, the final divorce decree must be present to show the marriage lasted at least ten years. If you are caring for a minor or a disabled adult, you will need custody or guardianship papers to prove your legal authority to act on their behalf.

Work and Military History

The benefit amount depends on the earnings record of the deceased. You should have the most recent W-2 forms or self-employment tax returns. Specifically, look for Schedule C or Schedule SE if they owned a business. These documents help the agency calculate the correct payment. If the deceased served in the military, the discharge papers known as Form DD-214 are necessary. Military service can sometimes lead to higher benefits or satisfy specific eligibility windows. You can find more details in the official Survivors Benefits – Social Security guide.

Financial and Practical Information

The agency uses direct deposit for almost all payments. You need your bank account number and the routing transit number. Having a voided check or a bank statement makes this step easier. You should also keep any long-term care contracts and receipts from the facility where the deceased stayed. These are important for settling the estate and coordinating with other programs like Medicaid. If you have been acting as a caregiver, keep your records of expenses and medical history for the deceased. These can be vital if there are questions about dependent status or disability claims.

Managing Death Certificates

The death certificate is the primary key for every door you need to open. You can obtain certified copies from the funeral director or the state vital records office. It is a mistake to order only one or two copies. Banks, insurance companies, and government agencies often require their own certified version. Order at least ten copies to be safe. A certified copy has a raised seal or a specific multicolored signature from the registrar. If you need more later, you can request them through the health department in the county where the death occurred. Some states also offer online ordering through services like VitalChek. Be prepared to pay a fee for each copy; these fees vary by state and can range from $10 to $30 per certificate. It is best to pay this fee upfront to avoid delays later.

Organizing these papers requires a simple system. Use a sturdy binder with plastic sleeves. Put the original documents in the sleeves so they do not get damaged or lost. Label each section clearly. You might have one section for identity, one for financial records, and one for legal authority. Keeping a digital backup is also smart. Scan everything and save it to a secure cloud drive. This allows you to share information with attorneys or family members quickly. Always keep the physical originals in a fireproof box or a safe when you are not using them for an appointment.

Navigating Power of Attorney and Guardianship

Many caregivers use a Power of Attorney (POA) to manage affairs while a loved one is alive. It is vital to remember that a Power of Attorney ends the moment the person dies. You cannot use that document to sign checks, access accounts, or make decisions after their passing. The Social Security Administration does not automatically recognize private legal documents like a POA for the purpose of receiving or spending benefit checks. If you were a court-appointed guardian or conservator, your role might change or continue depending on state law and the specific court order. If the deceased was unable to manage their own affairs, the Social Security Administration may have already appointed a representative payee. If not, you may need to apply for this status to manage the survivor benefits for a minor or an incapacitated adult. Understanding Who can get Survivor benefits helps clarify who has the legal standing to claim these funds.

Immediate Actions to Protect Assets

You should take several steps within the first few days after a death. Notify the employer of the deceased immediately. This triggers the process for final paychecks and life insurance. You also need to contact any pension offices. If the deceased was receiving Social Security retirement or disability payments, those must stop. Any payment sent for the month of death or later must usually be returned. Notifying the bank helps prevent unauthorized transactions. You should also preserve the proof of earnings. This includes tax returns from the last two years and any recent pay stubs. These records ensure the Social Security Administration has the most accurate data for your claim. If you wait too long, these documents can be harder to find. Protecting the earnings history is the best way to secure the maximum benefit allowed by law. This preparation sets the stage for the formal filing process which involves specific interviews and follow-up tasks.

How to File a Claim and Manage the Social Security Process

The process of claiming survivor benefits begins with a direct notification to the Social Security Administration. You cannot complete a full application for these benefits through the website. While you can find information online, the actual filing requires a conversation with a representative. Most people start by calling the national toll-free number at 1-800-772-1213 to schedule an appointment. You can also visit a local field office without an appointment, but you should expect long wait times. Scheduling a specific time for a phone interview or an in-person meeting is the most efficient route for a busy caregiver.

Filing Routes and Online Limitations

You can use the online portal to check Who can get Survivor benefits | SSA – Social Security but the system will eventually direct you to speak with a staff member. The agency requires a verbal or in-person interview to verify identities and relationships. If you are already receiving benefits on your own record, the process might be slightly shorter, but a formal claim for the higher survivor amount is still necessary. For those caring for minor children or disabled adults, the interview is mandatory to establish the need for a representative payee. Remember the 12-month retroactive limit mentioned earlier; early filing ensures that the transition from the deceased worker’s retirement or disability benefits to survivor benefits happens without a long gap in your household budget.

What to Expect at Your Appointment

During the interview, the representative will ask for the deceased worker’s Social Security number as well as their date of death. They will verify your relationship to the deceased. If you are a surviving spouse, they will ask about the length of your marriage. If you are an ex-spouse, they will need to know if the marriage lasted at least ten years. You should have a list of questions ready to ensure you get all the information you need. Sample questions for the representative

What is the exact monthly benefit amount for this claim? Does the family maximum limit apply to our situation? What is the earliest date payments can begin? Are there any retroactive benefits available for the months since the death? How will my own future retirement benefits be affected if I take survivor benefits now?

Submitting Your Documentation

The agency requires original documents or copies certified by the issuing office. Photocopies are not acceptable for proof of birth, marriage, or death. You have two main ways to submit these. You can bring them to your local field office in person. If you choose this, always ask the clerk for a stamped receipt that lists every document you handed over. This prevents documents from getting lost in the system without a paper trail. The second option is mailing them. If you mail original documents, use certified mail with a return receipt requested. This provides legal proof that the agency received your records. The agency will mail your original documents back to you once they are scanned into the system. You can find a full list of what you might need in the official Survivors Benefits – Social Security guide.

The Role of a Representative Payee

When a survivor is a minor or an adult who cannot manage their own finances, the agency appoints a representative payee. This is a person or an organization that receives the payments and ensures they are used for the beneficiary’s needs. A power of attorney does not grant you the right to manage Social Security funds after a person dies. You must apply specifically to be a payee using Form SSA-11. The agency will conduct a brief background check and an interview to ensure you are suitable for the role. They prioritize relatives and close friends who have a consistent interest in the beneficiary’s well-being. As a payee, you must keep records of how the money is spent. You will likely need to file an annual report showing that the funds went toward housing, food, and medical care.

Direct Deposit and Payment Timelines

The agency no longer issues paper checks in most cases. You must provide a bank routing number as well as an account number during the application. If you are a representative payee, the bank account should be set up in a way that shows the beneficiary owns the funds but you have the authority to manage them. The initial intake usually takes about an hour. After that, the waiting period for a decision can range from 30 to 90 days. Delays often happen if the agency is waiting for verified earnings records or if there is a backlog at the local office. To speed up the process, ensure all your documents are submitted at the time of the first interview. Follow up every two weeks if you have not received a notice of award.

Appeals and Escalation

If your claim is denied, you have the right to appeal. The first step is a request for reconsideration. You must file this within 60 days of receiving the denial letter. It is vital to meet this deadline or you may have to start the entire process over. If the claim is still denied after reconsideration, you can request a hearing before an administrative law judge. If the hearing does not resolve the issue, the third step is a review by the Appeals Council. The final step involves filing a lawsuit in a federal district court. Most successful appeals happen at the hearing stage. If you experience an unusual delay that lasts several months without explanation, you can escalate the matter. Ask to speak with a supervisor at the field office. If that does not work, contact the office of your local member of Congress. Congressional staffers have liaisons who can look into stalled cases.

Legal and Financial Coordination

Survivor benefits are considered unearned income. This can significantly affect Medicaid planning or ongoing long-term care contracts. If the survivor is in a nursing home, the increase in income might require a change in their Medicaid spend-down calculation. Failure to report the new income to the state Medicaid office can lead to overpayment penalties. Furthermore, survivor benefits might affect the state’s ability to recover costs from the deceased person’s estate. Medicaid estate recovery rules are complex and vary significantly by state; these rules determine if the state can claim assets to pay back the cost of long-term care. You should coordinate with an elder law attorney to ensure the new benefits do not disqualify the survivor from essential medical coverage. While Social Security payments are not part of the probate estate, the documents used in probate are often the same ones needed for the claim. Keeping these processes synchronized saves time and reduces stress for the caregiver.

Communication Templates

Phone Script for Initial Claim

I am calling to report the death of a worker and to start a claim for survivor benefits. My name is [Your Name] and I am the [Relationship] of the deceased. The deceased worker's name was [Worker Name] and their Social Security number was [Number]. I would like to schedule an appointment for a formal application interview. Please let me know if this will be a phone interview or if I need to come to the local office.

Authorization for Release of Information

I, [Your Name], authorize the Social Security Administration to release information regarding my claim for survivor benefits to [Name of Attorney or Helper]. This authorization includes details about my payment status, pending documentation, and any issues causing a delay in processing. This authorization is valid until [Date or Event].

Final Recommendations and Next Steps

Managing the aftermath of a loss feels like navigating a storm without a map. You are dealing with grief while the clock ticks on legal deadlines. Taking control of the paperwork is the best way to protect your family’s financial future. This final chapter provides a clear path forward, focusing on the most urgent tasks and the long-term steps required to secure every benefit available to you.

Immediate Emergency Checklist for the First Week

The first seven days are often a blur of phone calls and arrangements. You must prioritize three specific actions to prevent delays in your Social Security claim.

Step 1. Obtain Certified Death Certificates

You should request at least ten certified copies from the funeral director or the state vital records office. Photocopies are rarely accepted by government agencies. You will need these for the Social Security Administration, banks, life insurance companies, and the Department of Veterans Affairs. Each copy usually carries a small fee. Having them ready prevents you from waiting weeks for new ones later.

Step 2. Notify the Social Security Administration

Most funeral homes report the death to the SSA, but you should not assume this happened. Call the national toll-free number at 1-800-772-1213 or contact your local field office. Inform them of the death immediately. This stops the deceased person’s retirement or disability payments and prevents the headache of having to return overpayments later. This call also starts the process for the one-time lump sum death payment of $255, available to eligible surviving spouses.

Step 3. Secure the Legal Document Binder

Locate the original will, any trust documents, the deceased person’s Social Security card, and their birth certificate. If they served in the military, find the DD-214 discharge papers. These are essential for determining Who can get Survivor benefits. Remember that a Power of Attorney expires the moment the person passes away; you can no longer use it to sign documents for them and must now rely on the will or court-appointed status.

The 90 Day Roadmap for Ongoing Legal Tasks

Once the first week passes, you can focus on the deeper administrative work. This period is about confirming eligibility and filing formal claims.

Month One. Verify Eligibility and File Claims

Review the specific requirements for Social Security survivor benefits: Who qualifies in 2025?. Spouses usually qualify at age 60, while disabled widows can apply as early as age 50. If you are caring for a child under 16, you might qualify regardless of your age. Gather your own birth certificate and marriage license. If you were divorced, find the final divorce decree. The SSA requires original documents or certified copies, which they will return to you after processing. Do not wait to file even if you are missing a document; the SSA can often help you find what is missing.

Month Two. Coordinate with Other Agencies

If the deceased worked for the federal government, contact the Office of Personnel Management to check for Survivors – OPM benefits, as these rules differ from Social Security. You must also notify the pension office of any former employers and check for private life insurance policies. If the deceased was on Medicaid, speak with an elder law attorney to understand how survivor benefits might affect your own Medicaid eligibility and to ask about estate recovery rules in your state.

Month Three. Address Guardianship and Appeals

If the survivor is a minor or an adult with a disability, the SSA may appoint a representative payee to manage the money for the beneficiary. This is different from a court-ordered guardianship. If the SSA denies your claim, you have 60 days to file an appeal. Start with a request for reconsideration. If that fails, you can request a hearing before an administrative law judge. This is the time to consult legal aid or an elder law clinic if the case is complex.

Essential Resources for Caregivers

You do not have to do this alone. Several organizations provide the forms and guidance you need to succeed.

- Social Security Administration. Call 1-800-772-1213 between 8:00 a.m. and 7:00 p.m. Monday through Friday. Use the online field office locator to find an office near you for in-person appointments.

- Legal Aid and Elder Law Clinics. Many cities offer free legal help for seniors and their caregivers. They can help with probate issues and the transition from a Power of Attorney to an estate executor.

- Official SSA Publications. Download the PDF for Survivors Benefits – Social Security. It contains the most current rules for 2025 and lists the exact documents you need for every type of survivor claim.

Organizing your documents today protects your family tomorrow. Timely filing ensures you receive the maximum What you could get from Survivor benefits. It also protects the legal interests of the person you cared for so deeply. Stay persistent with the SSA. Keep a log of every person you speak with at the agency and note the date of every call. This record is vital if you ever need to appeal a decision. You have worked hard as a caregiver; now is the time to ensure the system works for you.

References

- Social Security survivor benefits: Who qualifies in 2025? — In 2025, spouses, children, and even dependent parents may qualify if the deceased person paid into Social Security.

- Survivors – OPM — The spouse may be eligible for the Basic Employee Death Benefit, which is equal to 50% of the employee's final salary (average salary, if higher), plus $15,000 …

- [PDF] Survivors Benefits – Social Security — But no one needs more than 10 years of work to be eligible for any Social Security benefit. Page 6. 2. Under a special rule, we can pay benefits to your.

- Understanding Social Security Widow Benefits in 2026 — First, the spouse who passed away must have worked and paid Social Security taxes for a specific time. Also, the surviving spouse needs to meet …

- Social Security When a Spouse Dies – Guide to Survivor Benefits — You can apply for survivor benefits as early as age 50 if you have a disability that occurred within seven years of your spouse's death. If you …

- [PDF] What You Need to Know When You Get Retirement or Survivors … — In 2025, we consider a person younger than full retirement age (age 67 for people born in 1960 and later) retired, if monthly earnings are $1,950 or less.

- What you could get from Survivor benefits | SSA – Social Security — You can get up to 100% when you reach your Full Retirement Age for Survivor benefits (between ages 66–67).

- Who can get Survivor benefits | SSA – Social Security — You may be eligible if you're the spouse, ex-spouse, child, or dependent parent of someone who worked and paid Social Security taxes before they died.

- Provisions Affecting Family Member Benefits – Social Security — Allow divorced aged spouses and divorced surviving spouses married 5 to 9 years to get benefits based on the former spouse's account. Divorced aged and …

- [PDF] Social Security Benefits for Widows and Widowers FAQ – MFS — What are the requirements for receiving a survivor benefit? □ You are eligible for a survivor benefit even if you never worked or paid into. Social Security.

EMPTY